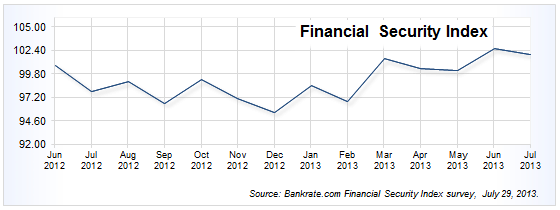

Bankrate's monthly survey of six questions measures how secure Americans feel about their personal finances compared to 12 months ago. From July 3-7, 2013, telephone interviews (on landlines and cellphones) with 1,005 adults living in the continental U.S. were conducted by Princeton Survey Research Associates International. The results of Bankrate's Financial Security Index have a margin of error of plus or minus 3.6 percentage points. This month, the index decreased to 102, down 0.7 points since June 2013.Add to website or blog X

Select AllPress Ctrl + C to copyClose

Highlights:

- Respondents making six figures prefer stocks (34%) and real estate (32%). People making less than that prefer cash investments (29%), real estate (23%) and precious metals (18%).

- Cash investments were preferred by 32% of people with a high school education or less, compared to 24% of those with some college education and 19% with a college degree.

- Women prefer cash investments slightly more than men do (30% versus 21%), while men prefer stocks more than women do (18% versus 11%).

Add to website or blog X

Select AllPress Ctrl + C to copyCloseHighlights:

- Around 1 in 4 men (26%) are feeling more job-secure today, compared to 1 in 6 women (16%).

- 22% of Republicans, 17% of Independents and only 3% of Democrats say their job security has decreased in the past 12 months.

- More than one-third of those 65 and older (37%) feel less secure in their jobs, versus an average of 12% of adults in younger age groups.

Add to website or blog X

Select AllPress Ctrl + C to copyCloseHighlights:

- 26% of people who make at least $30,000 a year feel more comfortable with their savings, while just 12% of those making less than that do.

- 2 in 10 adults younger than age 65 (21%) are feeling more comfortable with their savings, compared to approximately 1 in 10 of those (11%) who are at least that age.

- 35% of respondents without a college degree felt less comfortable with their savings, while 23% of more educated respondents felt the same way.

Add to website or blog X

Select AllPress Ctrl + C to copyCloseHighlights:

- 13% of college graduates feel less comfortable about their debt, compared to 23% of those without a college degree.

- 17% of full-time workers feel less comfortable with their debt, versus 25% of people employed part time.

- 28% of people making less than $30,000 a year are less comfortable with their debt, but only 17% of people with higher incomes feel that way.

Add to website or blog X

Select AllPress Ctrl + C to copyCloseHighlights:

- 34% of men report their net worth is higher today, versus 24% of women.

- 20% of Republicans and 18% of Independents say they have a lower net worth, versus 11% of Democrats.

- 31% of respondents younger than 65 report a higher net worth, compared to 19% of people 65 and older.

Add to website or blog X

Select AllPress Ctrl + C to copyCloseHighlights:

- 35% of men say they're doing better today, versus 22% of women.

- 26% of Republicans and 25% of Independents say they're worse off today, compared to 14% of Democrats.

- 31% of people younger than 65 say they're doing better today, but just 15% of respondents 65 or older agree.

Editor's note: Percentages may not equal 100, due to rounding.

Bankrate's Financial Security Index gauges how Americans feel today versus a year ago on vital financial matters. An index value of less than 100 indicates declining levels of financial security; a value greater than 100 reveals higher levels of security compared to 12 months ago. |

Add to website or blog X

Select All Press Ctrl + C to copyCloseSource: http://www.bankrate.com/finance/consumer-index/financial-security-charts-0713.aspx

dodgers Kevin Ware Google Nose success Cookies april fools day april fools day

Social gamers Zynga have nixed plans to pursue real-money online gambling opportunities in the United States. The company dropped the bombshell as part of its Q2 earnings report, which saw Zynga?s revenues fall 31% to $231m, resulting in a net loss of $15.8m for the three months ending June 30. In a statement accompanying the report, new CEO Don Mattrick said Zynga needed to ?get back to basics? and take ?a longer term view on our products and business.? Mattrick said Zynga expected ?more volatility ? than we would like over the next two to four quarters.?

Social gamers Zynga have nixed plans to pursue real-money online gambling opportunities in the United States. The company dropped the bombshell as part of its Q2 earnings report, which saw Zynga?s revenues fall 31% to $231m, resulting in a net loss of $15.8m for the three months ending June 30. In a statement accompanying the report, new CEO Don Mattrick said Zynga needed to ?get back to basics? and take ?a longer term view on our products and business.? Mattrick said Zynga expected ?more volatility ? than we would like over the next two to four quarters.?